Are you dreaming of a financially secure retirement, but overwhelmed by the complexities of planning? Pierce Sullivan's The Ultimate Retirement Planning Blueprint offers a simple, six-step formula to achieve your retirement goals. This accessible guide cuts through financial jargon, providing clear worksheets and actionable strategies for everyone, regardless of age or income. Learn how to pinpoint your retirement vision, calculate savings goals, and unlock "backdoor" strategies used by the wealthy. Discover how to compress your savings timeline, design a fulfilling retirement lifestyle, and protect your funds from inflation. Even if you're a late starter or feel technologically challenged, this blueprint empowers you to build a confident and comfortable retirement.

Review The Ultimate Retirement Planning Blueprint

"The Ultimate Retirement Planning Blueprint" by Pierce Sullivan isn't just another retirement guide; it's a friendly hand reaching out to help you navigate the often-daunting world of financial planning for your golden years. The book's strength lies in its simplicity and accessibility. Sullivan masterfully avoids the dense jargon that often overwhelms readers, instead opting for clear, concise language and a straightforward six-step formula that makes the process feel manageable, even exciting.

What struck me most was the book's holistic approach. It's not just about numbers and spreadsheets; it's about connecting your financial goals with your personal vision for retirement. The emphasis on defining your "retirement happiness map" – visualizing the life you want to live – is truly insightful. It encourages you to think beyond mere financial security and consider the lifestyle, activities, and relationships that will bring you fulfillment. This focus on personal meaning helps to keep the planning process engaging and motivating, rather than feeling like a tedious chore.

The six-step formula itself is brilliantly structured. Each step builds upon the previous one, creating a logical and progressive pathway towards your retirement goals. I found the inclusion of practical exercises and worksheets particularly helpful. These tools allow you to actively engage with the material, personalizing the plan to your specific circumstances. Whether you’re a young professional just starting to think about retirement or someone closer to retirement age looking to make adjustments, the book provides adaptable strategies that work for various situations.

The book also tackles common anxieties and misconceptions head-on. Sullivan addresses the fears of those who feel they’ve started too late, haven't saved enough, or are unsure how to navigate the complexities of different investment vehicles. He offers reassurance and practical advice, emphasizing that it's never too late to begin planning and that even small, consistent actions can make a significant difference over time.

While I appreciated the book's focus on actionable strategies, I also valued its emphasis on long-term perspective. It goes beyond simply calculating how much you need to save; it guides you through thinking about how you'll manage your finances in retirement, including strategies for generating additional income and protecting your savings from inflation.

Overall, "The Ultimate Retirement Planning Blueprint" is a valuable resource for anyone seeking to secure a comfortable and fulfilling retirement. It’s a reassuring guide that empowers you to take control of your financial future, offering a blend of practical advice, motivational encouragement, and a refreshing emphasis on aligning your financial planning with your personal dreams. I would highly recommend this book to anyone feeling overwhelmed or uncertain about their retirement planning journey. It's a clear, concise, and genuinely helpful companion for this significant life stage.

Information

- Dimensions: 5.5 x 0.36 x 8.5 inches

- Language: English

- Print length: 144

- Publication date: 2024

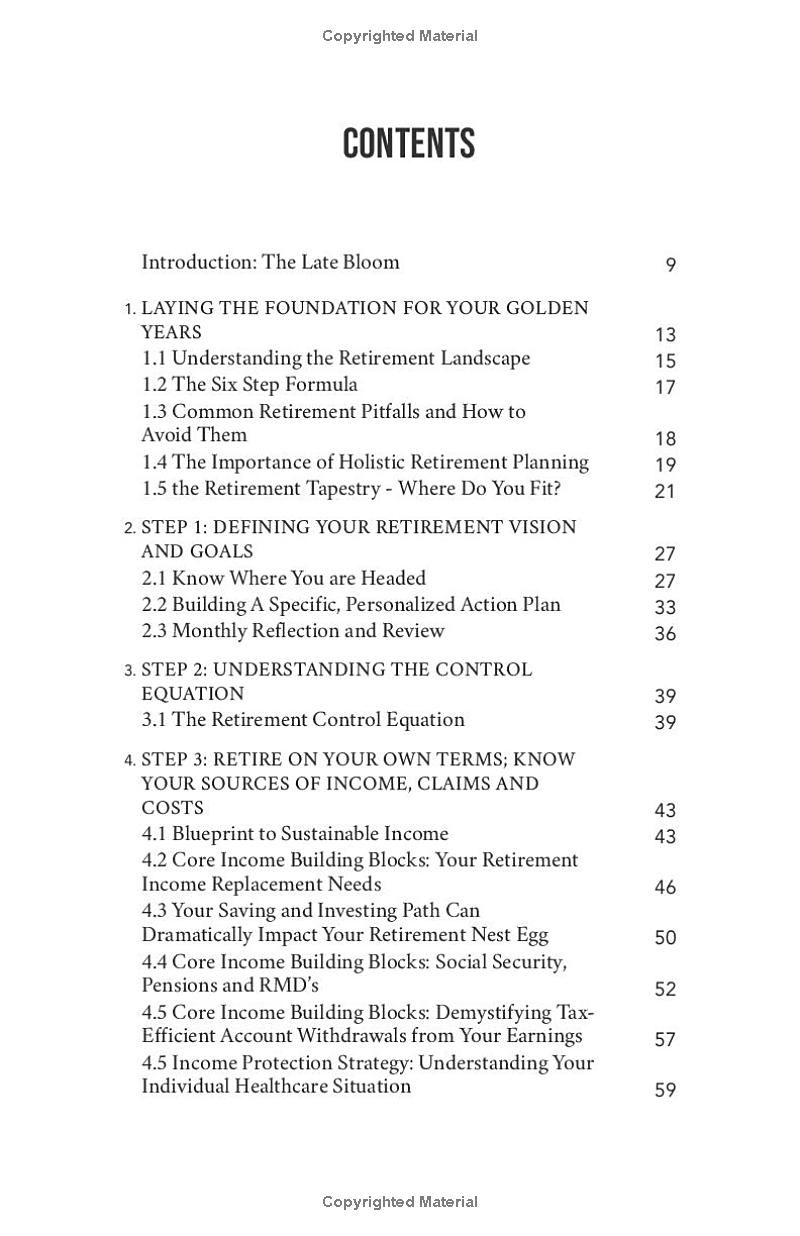

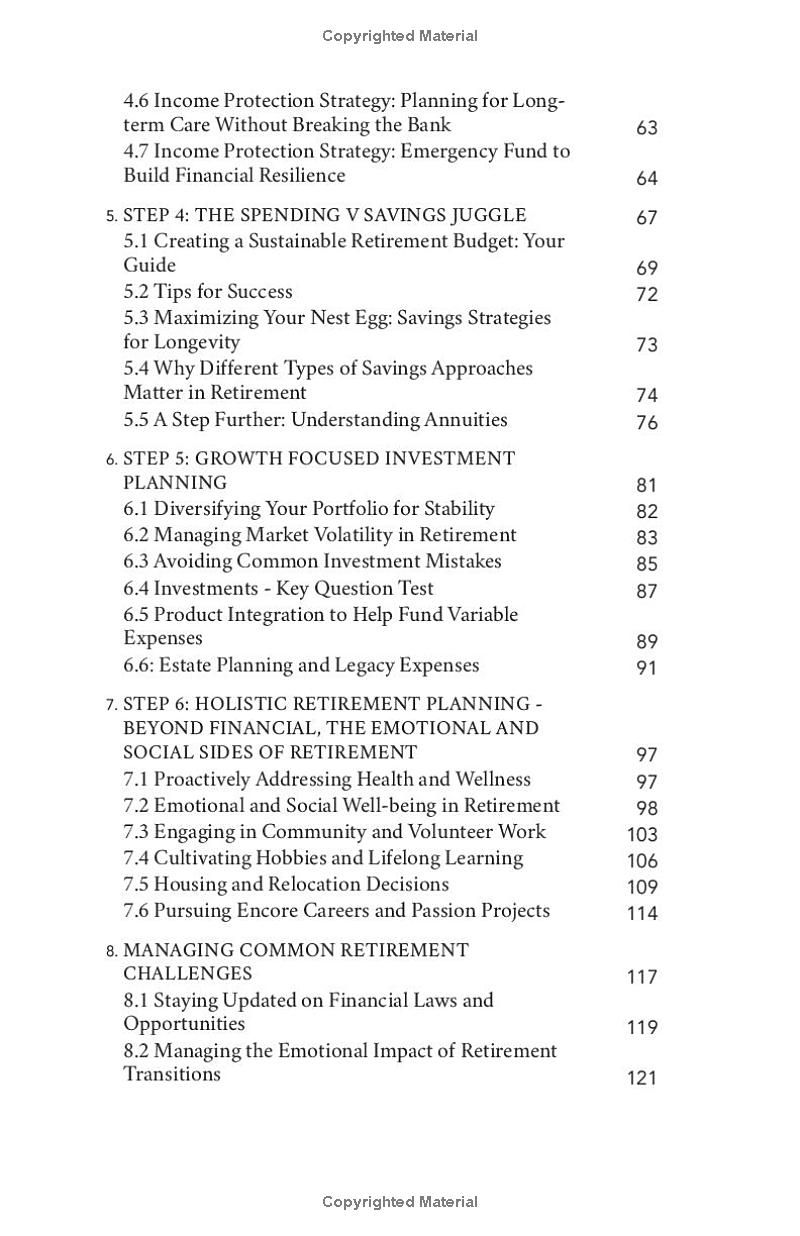

Book table of contents

- Introduction: The Late Bloom

- LAYING THE FOUNDATION FOR YOUR GOLDEN YEARS

- Understanding the Retirement Landscape

- The Six Step Formula

- Common Retirement Pitfalls and How to Avoid Them

- The Importance of Holistic Retirement Planning

- the Retirement Tapestry Where Do You Fit?

- STEP 1: DEFINING YOUR RETIREMENT VISION AND GOALS

- Know Where You are Headed

- Building A Specific, Personalized Action Plan

- Monthly Reflection and Review

- STEP 2: UNDERSTANDING THE CONTROL EQUATION

- The Retirement Control Equation

- STEP 3: RETIRE ON YOUR OWN TERMS; KNOW YOUR SOURCES OF INCOME, CLAIMS AND COSTS

- Blueprint to Sustainable Income

Preview Book